Engagement & Retention project | BigBasket

BigBasket Journey & Challenges

Introduction:

Started in 2011 as a POC with a very small budget and pretty manual process in Bengaluru, the 5 founders completed PMF for the next couple of quarters by understanding the nuances of the online grocery industry. By physically procuring fruits, vegetables, etc. and delivering the orders themselves, they spent time in understanding the users, needs, pain points and optimized for the best solutions that can be provided.

In 2012, after a series A funding round of INR 61 crores, BigBasket went on to expand in other Tier 1 cities with physical warehouses in each city. They started celebrity marketing campaigns and in 2016 initiated the 60 min delivery service with sales crossing INR 1000 crores and 5million customers in 2017. In 2019, BigBasket became a unicorn and acquired several smaller niche companies in the grocery segment. In 2020, gross sales crossed INR 1 billion and they got ready for an incremental acquisition by the TATA starting 2021.

Fast-forward 2024 and BigBasket is one of the biggest grocery apps in the country in terms of catalogue, users, revenue and geographies catered. With 2 major offerings and 1 offering restricted in a few locations, BigBasket is rivaling in both ecommerce in the grocery segment as well as quick commerce giants.

Current Stage:

While being India's 1st online grocer, BigBasket focused on slotted deliveries for the longest time, they saw the rise of Q-commerce as a segment a little late and then had to heavily invest, really fast. Today 30% of the total sales is attributed to the Q-commerce arm where it is fighting for market share with competitors like BlinkIt, Dunzo, Zepto and Swiggy Instamart.

Source: Thearchweb.com

Types of offerings and brands:

Along with a few minor categories, the 2 main delivery categories for BigBasket are BB SuperSaver (Slotted - 2 hour deliveries) & BB Now (10-12 minute deliveries). While the most revenue, daily sales and number of orders (about 70%) come from the BB SuperSaver product, BB Now is growing at a much faster pace with a product catalogue of more than 6000 products. 80% of the BB Now orders are delivered in 10-12 minutes as per reports from the company.

Over the years, they have focused on creating in-house brands for groceries for a range of products and 2/3 levels based on quality like BB Popular, BB Royal and BB Organic. They also have their own products in the home maintenance category under the label BB Home and Fresho! in the premade & snacking category. Their home brands are significantly discounted compared to other brands that they sell and drive a good chunk of revenue for the company.

Challenges:

The most significant challenge that BigBasket is facing today is fierce competition in acquiring and retaining customers while increasing market share. A 4/5 way battle (80% of the total market) where currently BlinkIt is leading with BigBasket coming in at 4th or 5th in most geographies, they have to up their game to retain and acquire new customers for BB Now.

And while other competitors are focusing only on Q-commerce, the competitive advantage in the long run for BigBasket is that, they are hedging their bets, by focusing on existing 2 hour deliveries as well as growing Q-commerce. This has the disadvantage of limiting the resources and efforts it can put on any one category and also slowing it down to a certain extent.

Why did I choose BigBasket for my EnR Project?

As a casual to core to power user of BigBasket over the last 5 years, in 4 different cities (Mumbai, Pune, Bengaluru and Indore), I have seen the categories move along with the product offerings and delivery timings. For me the most satisfying thing about BigBasket is how they handle customer complaints and a no questions asked return/refund. The benefit of buying groceries physically is that you can ensure quality to a certain extent with the look & feel of the product which is near impossible with deliveries but with a smooth return process, you remove the risk of bad quality.

While I have seen the growth, I have also been part of discussions where people are not satisfied and have moved on to other apps. For the longest time I didn't need to, but now even I have secondary apps for categories not present with BigBasket or when delivery times are longer. The real life challenge that BigBasket is facing today, makes it a very good candidate for the Engagement and Retention project, as even they are actively trying to figure out and implement solutions for this.

My primary reason for choosing BB is to identify users, how & why they engage with BigBasket and what is causing them to move away from one of my favorite apps. And if possible, define some genuinely executable strategies to increase retention.

Value Proposition

Core Value Prop:

The core value proposition of BigBasket is to allow customers to purchase online - the things they need to run their daily life more efficiently, at competitive prices and have them delivered at a pre-determined time. These things can include wet groceries, dry groceries, pet supplies, kitchen supplies, child care products, beauty care products, medicines, exotic and gourmet products, etc.

How do users currently experience this core value proposition (CVP)?

Customers use the BigBasket app, choose from any of the sub-products like BB SuperSaver (Delivery in 2 hours) or BB Now (Delivery in 10-12 minutes) and order from the catalogue of products listed under them. Once the order is placed, it is delivered at the time that was shown and agreed upon before placing the order. BigBasket removes the need for you to go to the physical stores to buy groceries and provides with convenience of buying them at your fingertips. The catalogue is wide and carries products ranging from edibles (perishable, non-perishables), cleaning supplies, utensils and home equipment, gourmet food, beauty & cosmetics, pet and child care, etc.

User Types & Frequency

Active User:

For BigBasket, based on it's Core Value Proposition and the JTBD of the customer, an activation happens when a user places an order on the app after adding product(s) to the cart on any of the products (BB SuperSaver, BB Now). Once they do this activity frequently (Daily, weekly, biweekly or monthly) based on their natural frequency for each product (using atleast one product frequently), they become active users for BigBasket.

Engagement Frameworks (Analysis & Selection):

Let's analyze all users and available data across Frequency, Depth and Breath to identify the primary and secondary frameworks:

- Frequency - For a company that charges the user 'handling fees' and 'delivery charges' for every order placed, frequency becomes an important characteristics in driving growth and revenue. Increasing the frequency of orders from existing users or adding orders from new users directly corresponds with revenue. The more the number of times user adds products to the cart and places an order, the more they experience the core value proposition and become a power user. Offering a wide variety of products from different categories help in increasing the number of orders i.e. the frequency and thus increasing the engagement for the user.

- Breadth - With multiple categories to choose from for the user based on their needs and meal planning frequency, users get a wide variety of options to choose from. BB Now for users looking for instant delivery products with less price sensitivity, BB SuperSaver for more planned purchases with a longer shelf life and better pricing. The synergies for the products come from the operational efficiency for BigBasket by using the same minor and major warehouses for both types of orders with some differentiation on execution.

As per user surveys, most users use a combination of services from BB (60%+) - Core Product + Sub Product like BB SuperSaver + BB Now. This shows that users experience the core value proposition by using products in tandem with each other based on their needs at that point in time - urgent, planned or per diem. Also, BB calls out categories within the primary ones separately as The Organic Shop, The Beauty Store, Fresho! Meats and Pharma (Product Integration with TATA 1mg).

Another reason to focus on Breadth is also how the company itself (along with competitors) identifies itself, by partnering with brands like Croma to increase the product range thus experiencing the core value proposition (ordering things that help them run their daily life effectively and having them delivered at a pre-determined time). - Depth - While AOV can be increased to a certain extent for all types of users - Power, Core and Casual, there is an upper limit to which a person or family would want to buy groceries irrespective of their mode of purchase. Increasing time spent on the platform would not co-relate to experiencing the core value proposition unless orders are also placed. Increasing money spent on the platform has an upper capping based on the household size and requirements of the user. Hence, frequency would be a better fit than Depth considering the core value proposition.

Framework Selection:

Framework Type | Meaning | Metric | Selection |

|---|---|---|---|

Frequency | Frequency of orders placed | Number of orders placed in a given period of time | Yes - Primary |

Breadth | Increase in delivery of core value proposition by using multiple offerings | Number and frequency of sub-products used | Yes - Secondary |

Depth | Time or Money spent by user on the core value proposition | Time or Money spent on buying using either of the products | No |

Natural Frequency:

The natural frequency for BigBasket SuperSaver, the product that is the primary one contributing to 70% sales, based on type of user and their orders, is as follows:

- Power User (AOV per order INR 1250) -

- 1-3 times in a week

- Once a week with an order value above INR 1250 (For users who order like to plan for the week and order for the whole week at once)

- Uses a combination of 2 products (BB Now and BB SuperSaver), both products every week once

- Core User (AOV per order INR 1800) -

- Once in 10 days

- Once in 2 weeks with an order value above INR 1800 (For users who have multiple avenues for Grocery purchases and use BB SuperSaver for specific products or timings)

- Uses a combination of 2 products (BB Now and BB SuperSaver), both products once in 2 weeks

- Casual User - Once a month / Once in 30 days

Note: INR 1250 is the average order value (AOV) declared by BigBasket for a blend of their van and bike deliveries for most repeat users. Hence, this benchmark is considered for Core & Power users as a threshold to consider them as Core or Power users. Also, AOV of INR 1800 has been identified for users who are more planned buyers and make 2-3 purchases a month but in bulk and mostly of dry groceries and utilities.

Natural Frequency for Sub-products:

A. BB Now

- Casual User - Once a month / Once in 30 days

- Core User - Once a week

- Power User - 2-5 times in a week, AOV per order - INR 400

B. BB Daily (Operated via a different mobile app but part of the BigBasket organization and delivery centers)

- Casual User - Once a month / Once in 30 days

- Core User - 1-3 times a week (Buys frequently but does not have a daily subscription, is active in the pay as you buy model)

- Power User - Daily (Has bought a monthly subscription for atleast 1 daily delivery item like milk or eggs), AOV per month - INR 2500

User Segmentation

ICP Deep Dive:

As per the user surveys and calls currently done for Tier 1 users (Pune, Mumbai, Bengaluru and Delhi), we have the following demographic information:

Marital status for the users is a mix of married and unmarried while salary range differs quite a lot between the users even in the same age and gender brackets ranging from INR 7 LPA to INR 50 LPA.

More than 65% of users in the age group of 36 to 60 are Female while in the 18 to 24 bracket are Male in much higher %. Between 25 to 35, there is a mix of sorts where one takes precedence over the other depending on family structure i.e. higher % of men when the status is unmarried vs a higher % of women when the status is married.

As for the usage preferences with respect to type of grocery (wet & dry), preferences of app, etc., we found the following:

Wet Groceries (Fruits, Vegetables, Meet, Bread, etc.)

Wet Groceries (Fruits, Vegetables, Meet, Bread, etc.)

Dry Groceries (Aata, Dal, Pulses, Masala, Tea, etc.)

Dry Groceries (Aata, Dal, Pulses, Masala, Tea, etc.)

Most Preferred way (Amongst Q-Commerce)

Most Preferred way (Amongst Q-Commerce)

While this gives us a base understanding of user characteristics and their preferences for buying groceries, let's dive deeper into Persona based engagement in the framework detailed below.

Following are the frameworks that we can use to segment users for BB:

A. Framework 1: ICP / Persona Based

Based on the information provided by users in surveys and phone call interviews, we have the following Persona based segmentation of users to identify their engagement needs & frequency with BigBasket:

Parameter | ICP1 | ICP2 | ICP3 |

ICP Name | Swati | Prabhu | Madhu |

Demographics | |||

Gender | Female | Male | Female or Male |

Age | 25 to 50 | 25 to 40 | 18 to 30 |

Location | Tier 1, 2, 3 cities | Tier 1, 2, 3 cities | Tier 1, 2, 3 cities |

Income | INR 8 LPA+ | INR 12 LPA+ | INR 4 LPA+ |

Professional Status | Working | Working | Student / Working |

Marital Status | Married | Married or Unmarried | Unmarried |

Kids | Yes | No | No |

Family / Household Size | 3 to 6 people | 1 to 4 people | 1 to 3 people |

Do they own a pet? | Maybe | Maybe | No |

Lifestyle | |||

App they use for Entertainment | Instagram, FB, OTT platforms (Netflix, Hotstar, Zee5), Music platforms (Spotify, Youtube Music), WhatsApp, Hike, Inshorts, etc. | Instagram, FB, OTT platforms (Netflix, Hotstar, Zee5), Music platforms (Spotify, Youtube Music), WhatsApp, Hike, Inshorts, Gaming apps, Dating apps etc. | Instagram, Music platforms (Youtube music), WhatsApp, Snapchat, etc. |

App they use for Utility | Gpay, Gmail, Ecommerce apps for household necessities, Apps for shopping, LinkedIn, Office suite (Microsoft) or Gsuite, Kids products apps like FirstCry | Gpay, Gmail, Ecommerce apps for household necessities, Apps for shopping, LinkedIn, Office suite (Microsoft) or Gsuite | Gpay, Gmail, Ecommerce apps for household necessities, Apps for shopping, LinkedIn, Learning platforms like Udemy, Office suite (Microsoft) or Gsuite |

How do they spend their time? | Working + Meetings, Discussions, On Social Media On OTT platforms consuming content With family physically Doing additional household chores | Working + Meetings, Discussions, On Social Media On OTT platforms consuming content With family virtually Doing additional household chores | Studying Meetings On Social Media On LMS platforms With family virtually On content platforms (preferrably free or shared) |

What do they spend their money on? | Investments (Gold, MFs, stocks, etc.) House help Supplies for kids/family Groceries Vacation Outings | Investments (Crypto, MFs, stocks, etc.) House help Family support Groceries Holidays Outings | Family support Groceries Treks/Trips Outings with Friends |

Tech Adoption | 8/10 | 9/10 | 10/10 |

Time Vs Money | Time | Time | Money |

BigBasket purchase experience | |||

Needs | Need a faster and convenient way of getting high quality groceries due to busy schedule | Need a convenient way of getting groceries without going to shops physically | Need a cheaper and faster way of getting groceries due to limited budget and busy schedules |

Pain Points | Very busy schedule due to managing work and household, less time to buy groceries, have to plan ahead for the week to keep up | Very busy schedule due to office work, less time to buy groceries, impromptu meal plans based on schedule | Busy schedule due to study/work, living alone/with flatmates so group or solo cooking, groceries should arrive when the cook does, etc. |

Solutions | Buy online from ecommerce/quick commerce apps | Buy online from ecommerce/quick commerce apps, ask local vendor to deliver | Buy online from ecommerce/quick commerce apps |

How frequently do they use the BigBasket app? | Once every week | 2 times a week | Once every week |

Product priority based on usage frequency? | BB SuperSaver > BB Now | BB Now > BB SuperSaver | BB SuperSaver > BB Now |

What features of the app do they interact with? | Search, Categories, Add to Basket, Basket Summary, Payments, Notify Me, Ratings/Reviews, Add to Wallet, Order Again, Add to Basket from Last order, Chat with Support | Search, Categories, Add to Basket, Basket Summary, Payments, Ratings/Reviews, Order Again, Add to Basket from Last Order, Chat with Support | Search, Categories, Add to Basket, Basket Summary, Payments, Ratings/Reviews, Order Again, Chat with Support |

Out of all the issues that can come up while placing or receiving an order, which are the ones that can lead to churning or go for alternatives? | Bad quality products - damaged, expired, spolit, over-ripe Bad packaging - Broken bags Unable to find products that they want to buy | Slow deliveries Unable to find products that they want to buy Bad packaging | Unable to find products that they want to buy Expensive products compared to other apps Less number of discounts and offers compared to other apps |

What measures can mitigate the risk of churn for this user? | Easy and quick returns / replacements Good packaging Increasing catalogue of products Better inventory management and restocking | Ensuring on-time deliveries with good packaging Increasing catalogue of products offer and better inventory management to restock items | Running offers based on purchase quantity Keeping competitive pricing across product categories Increasing catalogue of products |

What are the different stores that the users buy from within BigBasket, more frequently | BB SuperSaver | BB Now | BB SuperSaver |

B. Framework 2: Power / Core / Casual

Earlier in the assignment, we defined the natural frequencies of different types of users for the core as well as sub products. Based on the natural frequencies and user interviews, we further segment the users into Power, Core and Casual users. Power users are more frequent and recent users of the app, experiencing CVP more frequently, and they champion the app across other users with a strong word of mouth (WOM). Core users are those who experience the CVP of the product at fixed times with a longer frequency compared to Power users and they can be either more recent or more frequent based on the nature of their order. Casual users sparingly experience the CVP of the product and use it only when necessary or alternatives are not present, they are not very loyal to the product and may not have a positive WOM either.

This segmentation calls out unique characteristics, interactions with the app and depth/breadth of their orders and helps in defining how they experience the CVP.

Note: Framework considering only the core product i.e. BB SuperSaver while BB Now acts as a sub product. AOVs for different user types and product categories are a function of user interviews, user surveys and publicly available information by BigBasket.

Parameter | Power | Core | Casual |

Natural Frequency of orders | 1-3 orders per week | 1 order in 10 days | 1 order in 30 days |

Depth of orders (AOV) | INR 1250 AOV per week | INR 1800 AOV every 10 days | INR 1000 to 1500 AOV per order |

Breadth of orders (Sub-products used) | Orders from core product as well as occasionally from sub-products | Orders from core product and less frequently from sub-products | Orders from core product |

When was the last order placed? | In the last 7 days | In the last 15 days | In the last 30 to 60 days |

User of BB Now along with BB SuperSaver? | Yes | Sometimes | No |

Possible reasons on why they do the purchase using BigBasket SuperSaver | Impromptu purchases Requirement of fresher groceries Buys as the existing inventory is over Buys to cook or make things based on mood rather than plan | Planned buyer Keeps track of inventory and may purchase before existing inventory is finished Meal planning professionals Buys mainly dry groceries from BB Supersaver along with relatively lower perishables in the order | Need based - Buys only when it is not possible to get the products from exisitng sources Buys when products are urgently required with less time for physical purchase Need specific products not available in local stores Planned buyer - Plans for the month - only buying non-perishables |

What other ecommerce apps do they use? | BlinkIt, Zepto, Amazon, Flipkart | BlinkIt, Zepto, Amazon, Flipkart, Dunzo, Swiggy Instamart | BlinkIt, Zepto, Amazon, Flipkart, Dunzo, Swiggy Instamart, Dmart Online, Nature's Basket |

What are the things they may not like about the BigBasket app (Order process)? | Not finding the products they are looking for Not getting any offers Having to add to basket separately between BB Now and BB SuperSaver, no option to automatically move the entire basket item list | Not finding the products as per the plan that leads to either change in menu or order from elsewhere More expensive products compared to other apps | Unable to process payment due to technical issue Not able to find the products that they are looking for |

What are the things they may not like about the BigBasket operations (Delivery process)? | Damaged products, quality issues Slower deliveries | Quality issues with the products | Damaged products, quality issues Slower deliveries |

What is your frequency of buying these utilities from physical stores (Dmart, SmartBazaar, Mom&Pop stores)? | Once in 3 months | Once in 2-3 months | Once a month |

Do they buy gifts from the Gift Store on BigBasket? | Yes | Yes | No |

What are the features they use on the App | Search, Categories, Add to Basket, Basket Summary, Payments, Ratings/Reviews, Add to Wallet, Chat with Support | Search, Categories, Add to Basket, Basket Summary, Payments, Notify Me, Ratings/Reviews, Add to Wallet, Order Again, Add to Basket from Last order, Chat with Support | Search, Categories, Add to Basket, Basket Summary, Payments, Chat with Support |

Adding money to wallet? | Yes | No | No |

Do they have payment methods saved for future orders? | Yes | Yes | No |

Preferred payment method | UPI / Card | COD / Card / UPI | COD |

Revenue Contribution | Medium | High | Medium |

C. Framework 3: Advanced Segmentation

Based on the user surveys and calls done to understand the buying frequency and spends amount and last order date with BigBasket (any of the products - BB SuperSaver, BB Now) of users who categorized in the Champion, Loyalists, Potential Loyalists, At Risk and Hibernating users.

Trying to identify users with lower recency, specially with users who have moved on or parallelly started using competitors for their grocery needs, we got the following information:

About the users:

- Champions - Power users who overtime have used the features of bigbasket multiple times and have gone ahead to use sub-products as well. They have made BigBasket as a regular app and are high in both recency and frequency of usage

- Loyalists & Potential Loyalists - Power & Core users who use the app either more frequently or have it used it very recently. A continued use of the product with increasing CVP experience can make them Champions with time

- At Risk Customers - Core or Casual customers who had a good frequency of order but have not ordered recently and have missed their natural frequency multiple times. If their recency and consecutively frequency reduces further, they would become Casual / Churned users with time.

- Hibernating Customers - These are users who used the app with a certain frequency but it has been a long time since they have placed an order and are potentially churned and have moved on to another app/way of buying these products.

Further analysis and detailed phone call conversations with these identified (Power, Core and Casual) users, based on their last order, frequency of orders, order values, etc., lead us to segment users as follows:

Parameter | Champions | Loyalists | Potential Loyalists | At Risk Customers | Hibernating Customers |

User characteristic | Very frequently places orders consistently with a fixed average spend per order | Frequently places orders with fixed average spend per order and very recent last order | Medium frequency with varying spend per order, last order is very recent | Frequent users in the past with fixed average spend per order but have not ordered recently | Low frequency users with varied average spend per order, have not ordered recently |

Recency (Their recent use of the app) | This week | Last week | This week | Last month | 6 months ago |

Frequency (How frequently they use the app) | 1-3 times every week | Once in every 10 days | Once every 2 weeks | Once every 10 days | Once every month |

Money spent (per order) | INR 500 to INR 1500 | INR 1200 - INR 1800 | INR 400 to INR 1800 | INR 1200 - INR 1800 | INR 800 - INR 1200 |

Money spent (in 30 days) | INR 5000 to INR 15000 | INR 4000 to INR 8000 | INR 3000 to INR 5000 | INR 4000 to INR 8000 | INR 800 - INR 1200 |

User Type | Power | Core | Core / Power | Casual | Churned |

Breadth of Engagement | Core product + atleast 1 sub-product | Core product + sometimes 1 sub-product | Core product + sometimes 1 sub-product | Core product OR Sub-product (Any 1) | Core product OR Sub-product (Any 1) |

Depth of Engagement | High | High | Medium | Medium | Low |

Note: The number of users called was limited due to access and time restrictions and the AOV, frequency and recency numbers are an average of these calls, survey form and readily available information (specially about AOV) online on platforms like The Economic Times, Hindu Businessline, etc. The order value sum i.e. Money spent at BigBasket in 30 days is a function of AOV multiplied by the frequency (lowest for the minimum and highest for the maximum).

Engagement Product Hook

We use the Core and Power customer segments to identify & define engagement product hooks related to Frequency & Breadth respectively.

User Segmentation | Power | Core |

Goal | Core Product users -> Core and Sub-product users (Increase Engagement Breadth) | Core -> Power (Increase Engagement Frequency) |

Problem Statement | This user currently uses the BB SuperSaver once a week with an AOV of INR 1250. How can we motivate this user to use BB Now along with the existing SuperSaver order? | This user places one order in 10 days. How can we motivate this user to order at least in 10 days using any service combo (Now, SuperSaver)? |

Current Alternative | Buy individual items or buy smaller quantities from competitors like BlinkIt | Dmart Online - BB SuperSaver's competitor Lower pricing Pickup option available with Dmart Ready stores |

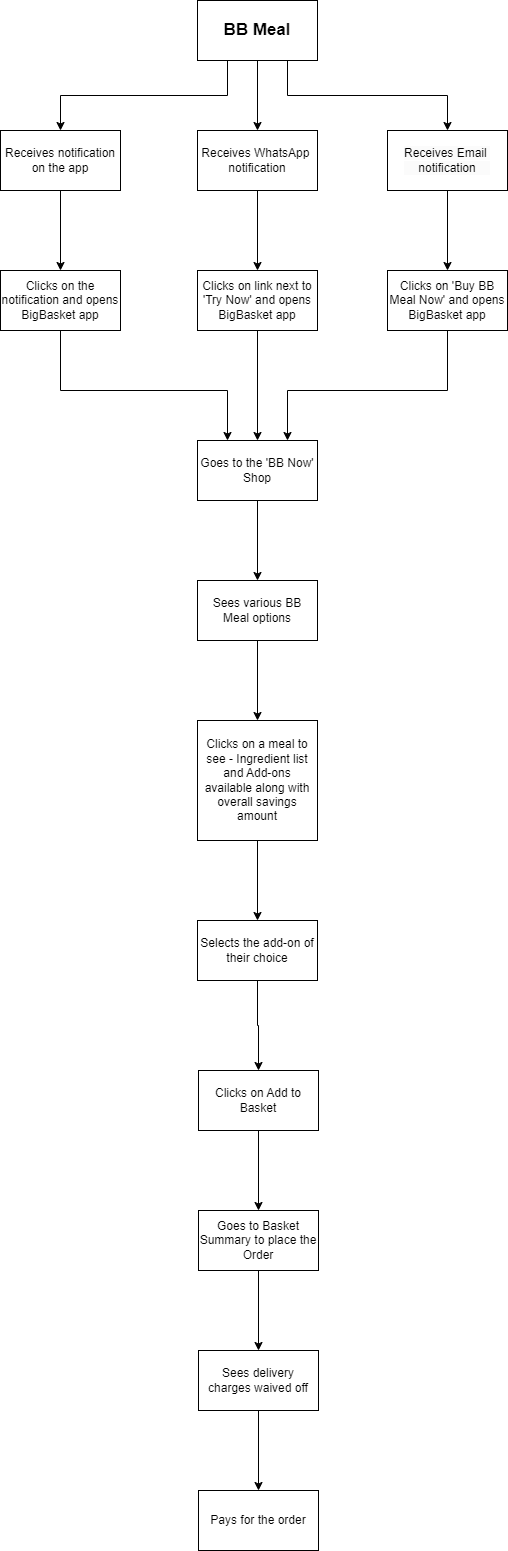

Solution (Summary) | Title: BB Meal exclusively on BB Now Goal: This type of power user is buying weekly based on replenishments required. This user can be encouraged to use BB Now to buy for making a specific recipe like pasta recipe + beverages option with a single CTA 'Add to Basket' for the combo. These could be a BB Now exclusive thing which encourages impromptu purchases on weekend nights, date nights, game days, etc. The goal is to increase the Breadth of usage by encouraging core product users to use BB Now. Offer: Buy all ingredients for a recipe saving time and energy of checking the recipe again and again to add to Basket. Select the number of people and the primary recipe and see everything added to Basket in one click with bundling options. No need to manage excess quantities or left overs. Also, delivery free on your first 3 BB Meal orders. Additional Notes: BB already does this for a recipe like 'Thai Curry' or 'Salads' where all veggies are put inside a box and delivered as a meal for 1 or 2. But it is not highlighted enough or there is no hook associated with it. | Title: BB Streaks Goal: This type of user uses BigBasket for either limited type of products or plans before purchasing based on current inventory. By introducing BB Streaks, we give them additional incentives to purchase frequently and maintain their frequency & recency across time. Offers: Place orders of above INR 600 to count it as a streak and get a cashback of incremental value (+1% or +2% with every order) i.e. without streak break the cashback % becomes better. |

Metrics to track | - CTR - # of BB Now orders - # of BB Meals ordered | - CTR - # of orders - Movement of natural frequency of these users from a Core to that of a Power user |

Success metric | - Increase in CTR - Increase in number of BB Now orders - Increase in conversion rate - Increase in BB Meals ordered | - Increase in CTR - Increase in number of orders - Movement of natural frequency of these users from a Core to that of a Power user - Increase in conversion rate |

- Detailed Solution (User Flow) - BB Meal

- Detailed Solution (User Flow) - BB Streaks

Engagement Campaigns

Based on the hooks defined above, we identify campaigns for each user segment (Power, Core, Casual), along with channels, content and other details about the campaigns. The goal is to write and elaborate the campaigns in depth that helps the implementation team plan it out well and execute the same.

A. Engagement campaigns for Casual users: These users have moved on or reduced the use of BigBasket app, primarily for these reasons (as per user interviews) - Better quality with competitor, faster delivery, a larger catalogue of products to choose from with the competitor.

Campaign # | Campaign 1 | Campaign 2 |

User Segmentation | Casual / At Risk Customers | Casual |

Natural Frequency | Once a month | Once a month |

Pain Point | Lower discounts and offers compared to competitors | Slower deliveries |

Campaign Target | Frequency | Frequency |

Goal of the campaign | To increase frequency of placing orders by introducing BB Streaks related additional discounts on one order placed every 15 days. We want to move this user from a Casual to a Core user. | To increase the frequency of orders for power users using BB Now by giving delivery time guarantees or cashback in wallet in case if they deliver later than the promised time while placing the order |

Offer | Place orders of above INR 600 to count it as a streak and get a cashback of incremental value (+1% with every order) i.e. without streak break the cashback % becomes better. Order 1 - 5% Order 2 - 6% If the streak is broken, it again starts with 5%. Counter restarts at the end of 30 days. | Delivery should happen within the "Guaranteed Time" mentioned before placing the order. If it is delayed then a scratch card with cashback (INR 50 to INR 150) would be made available to the user to claim or donate to an NGO. If they choose to claim then the amount would transfer to their BB Wallet. (Claim applicable for 5 orders a month) |

Pitch / Content | Push Notification: Gajal! Build your streak and get more 🤑 👉 5% cashback on your next order, increasing by 1% every order* 👉 More than 7000 products to choose from 👉 Free goodies on orders CTA: Check BB Streak >> | WhatsApp: 😵💫 Concerned that your order may not deliver on time? Don't worry, we got you covered! 😇

👩🍳👨🍳 Let's get cooking! |

Frequency | Once every 2 weeks, for 60 days | Once a week, for 60/90 days |

Timing | Alternate in the morning and evening | Alternate - One week in the evening and another in the morning |

Channel | Email / WhatsApp | WhatsApp / Push Notification |

Success metrics | - CTR - Increase in # of orders placed by the user - Increase in time spent on the app - % Increase in Revenue | - CTR - Increase in # of orders placed by the user - Increase in interaction with the app features - % Increase in Revenue |

B. Engagement campaigns for Core users: These users mostly either do scheduled purchases by planning out their inventory or buy as per their need and availability of the product at BigBasket. The users have not moved to being Power users and still buy with the competitors due to the following advantages that the competitor offers - A larger catalogue of products (User buys from 2 or more places depending on availability), Pricing of certain product categories is lower with competitors.

Campaign # | Campaign 3 |

User Segmentation | Core / Potential Loyalists |

Natural Frequency | Once in 2 weeks |

Pain Point | Some products are expensive compared to competitors |

Campaign Target | Frequency |

Goal of the campaign | To increase frequency of orders by giving them a free dry grocery item (over and above their basket list). The goal is to move this user from being a Core to a Power user. |

Offer | 2nd order (Even order #s) placed in 2 weeks gets a free dry grocery item that the user can choose from the list of free items shown on the basket summary screen. The list has relevant products that user has purchased in the past and values to INR 150. |

Pitch / Content | Push Notification: Get a free product with your deliveries 🆓🎁 👉 Every 2nd delivery gets you a free product 👉 Could be something you love, could be something we think you would love 👉 Delivering 7000+ products in 10 minutes CTA: Place Order Now >> |

Frequency | Once in every 3-4 days, running for 60 days |

Timing | Once in the evening and once in the morning - Alternating every 3-4 days |

Channel | Push Notification / WhatsApp / Email |

Success metrics | - CTR - Increase in # of orders placed by the user - Increase in time spent on the app - Increase in interaction with the app features - % Increase in Revenue |

C. Engagement campaigns for Power users: These users most exclusively use BigBasket for their purchases with maybe one other app as the secondary app. The reason for going to the secondary app or not using all the features / sub-products in the app are - Unavailability of certain product categories, Lower discounts & offers.

Campaign # | Campaign 4 | Campaign 5 |

User Segmentation | Power / ICP 1 | Power / ICP 2 |

Natural Frequency | Once a week (BB SuperSaver) | 2-3 times a week (BB Now) |

Pain Point | No major pain points but does not use all or major features of the app | No major pain points but does not use all or major features of the app |

Campaign Target | Breadth | Breadth |

Goal of the campaign | To increase breadth of using the app features, run an exclusive campaign on BB Now called BB Meal where users can buy ingredients for a recipe in fixed quantities (Meals for 2), also has add-ons of ready to consume items. (Elaborated in the Product Hook) | To increase breadth of engagement with the app features like BB Wallet by giving special discounts when orders are 100% paid for using the wallet |

Offer | Use BB Meal feature to buy ingredients for certain recipes based on number of people and add-ons required in a single click. For example - If the dish is Pasta for 4 people, 2 quantities of Pasta would be added to cart, along with add on options for a beverage. These would be at no delivery charges upto 5 Meal orders in a month. | Use your BB Wallet to place all your orders and get 5% discount on every 3rd order, upto INR 150 |

Pitch / Content | WhatsApp: 🌟 Introducing BB Meal! 🌟 Gajal, Want to spend less time planning ingredients for meals? Perfect! - Buy full recipe, in one click - Dinner for 2 - Buy add-ons that go with the meal - Beverages, Crackers, Ketchup! - Get free delivery of BB Meal orders! Try now: <link> 🔥 Quick purchases for quick meals 🛟 No wastage and no planning for left over ingredients | WhatsApp: 👝Big Wallet = Bigger Discounts💰 Hello Gajal! The Big Wallet Discount is here for you! Recharge your BB Wallet and use it to place all your orders this month. With every 3rd order placed using the Wallet, get wait for it 🥁 🥁🥁 Additional 5% Off

|

Frequency | Once a week, for 60/90 days | Once in every 3-4 days, running for 60 days |

Timing | 3 days after their usual planned order day | Once in the evening and once in the morning - Alternating every 3-4 days |

Channel | WhatsApp / Push Notification | Email / Push Notification |

Success metrics | - Increase in # of orders for BB Meal - CTR - Increase in interaction with app features | - Increase in # of orders placed by adding money to wallet first (Amongst the targeted group) - Increase in money that remains in the wallet between orders for the customer - Increase in frequency of orders due to funds available in the Wallet |

Campaign Samples:

Retention Design

Understanding Retention:

BigBasket, an Indian grocery delivery service, reported a revenue of about 74 billion Indian rupees in financial year 2023. A significant increase was noticed compared to the revenue of the previous financial year 2022.

As per various sources, the current retention for these products or industry (Q-commerce) is generally done at a D30 level i.e. a one month retention is considered to understand user behavior and preference. As per reports from BofA, Q-commerce industry's current monthly retention stands at 60-65% which soon flattens over time. We will consider D30 to D60 as the flattening time frame considering BigBasket also has categories that have a longer cycle compared to Q-commerce.

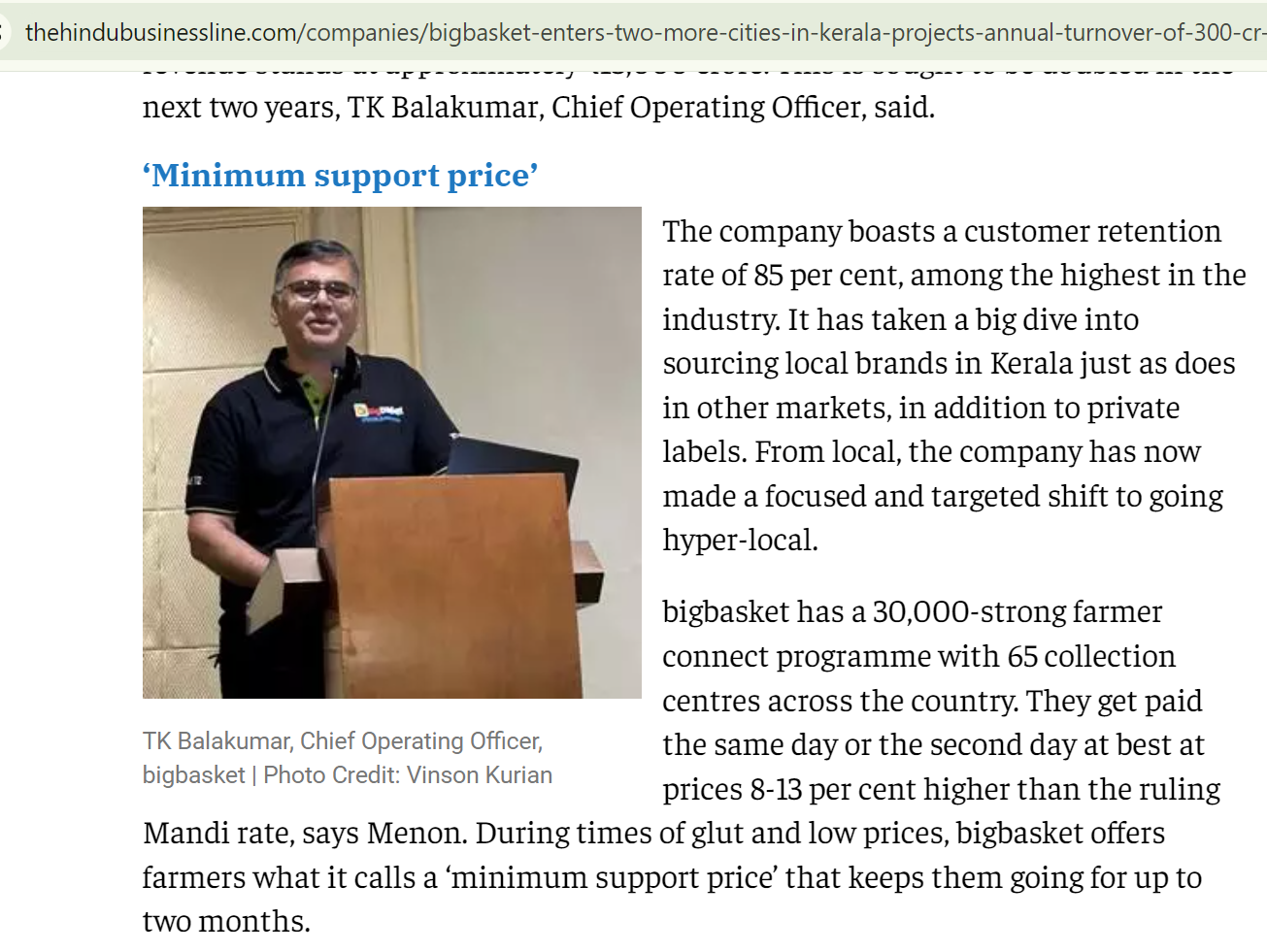

While it was challenging to get the actual Retention numbers for BigBasket, we have the following information available from different sources related to the company, industry and competitors:

- Industry retention rate (for Q commerce): 60 - 65% (Bank of America Analysts report - March 2024)

- BigBasket's claim about their retention: 85% (Hindu Businessline Article - Aug 2023)

- Ecommerce sector retention rate: 38% (Sprinklr - Feb 2024)

Based on these data points and understanding that only 30% of BigBasket's total orders come from BB Now which is pure-play Q-Commerce and that accounts to only 7% of the total market share when compared with competitors, a lower weightage will have to given to direct Q-commerce in understanding BB's retention rate. Considering this and the fact that BigBasket themselves claim a higher retention rate of 85%, it can only be assumed that both products BB Now and BB SuperSaver have different retention rates.

Even in user interviews, customers who used BB SuperSaver tend to stay with the application raising only quality and product unavailability as issues whereas BB Now customers tend to favour delivery times more aggressively. This may explain why they have a much lower market share (Blinkit 46% vs BB Now 7%) in the Q-commerce segment. Another inference could be that the remaining 7% who does stay with BB have a higher probability to stay and be retained instead of getting churned. That would explain the high retention rate that they claim as well i.e. low market share but the market that stays, stays.

Based on all the above insights and understanding that BigBasket's overall retention rate should be more than Ecommerce but less than Q-commerce slightly more inclined towards Q-commerce. This will bring our retention rate (monthly or D30) to 55 to 60%. As per our below churned user definition, this curve should flatten between D30 to M2/M3 to somewhere between 50 to 55%. We have tried to show the probable retention curve below:

Note: This is a best case estimate drawn after going through all the reference data available and may not be the real retention curve of BigBasket, only a close approximation. For getting the correct retention rate, we need to know the number of users at the start of the time period for ex. month start date and the number of users (out of these) that are still active at the end of the month. A division of the latter by the former multiplied by 100 gives us the retention rate for that period.

Which ICPs drive the best retention?

- ICP 1 - They drive the best retention as they are planned buyers and don't need groceries immediately most of the times. They are comfortable with planning to get better discounts, better quality products and manage delivery & keeping away groceries once in a few days or a week instead of every day. As 70% of the orders come from BB SuperSaver orders and ordering in bulk also leads to flat 5% discounts on a variety of products, these users tend to drive the most retention for BigBasket

- ICP 2 - While lower in total number of orders, these users prefer to stay to use BB Now for multiple reasons like better pricing, no delivery fee for orders more than INR 299, easy repeat orders to be placed, etc. They drive a good retention for BigBasket by ordering 2-3 times a week based on their needs and requirements.

ICP 3 is more price sensitive and looks for offers / discounts more often. They have a lower brand loyalty and hence would not be the best retention ICPs.

Which Channels drive the best retention?

- Organic - SEO - When you look to buy specific food items or fruits and vegetables, BB's SEO works beautifully in showcasing the best value proposition for the user in terms of pricing as well as additional labelling.

- Email marketing campaign - Personalized targeted campaigns with engaging content drives retention for users. Encouraging communications for Power users and indirect nudges for Core users drive users to engage more with the platform

- Push notifications (App) - Any sales on items frequently purchased or focusing on core issues that may block retention like product catalogue, delivery timings or pricing are focused in each notification with minimum effort. The campaigns are spaced to ensure that the user is not overloaded with notifications while keeping the notification itself focused on value proposition for the user. Their content in general on all channels is very personalized and depends on previous purchases.

- Content marketing (Video, Blogs) - BB adds a lot of content for recipes, healthy eating habits, recipe contests, etc. to keep users engaged and helps them view ingredients for these recipes or healthy alternatives. They also drive campaign specific to seasonal items like seasonal fruits, vegetables, festivals etc.

Video Example - https://www.youtube.com/watch?v=RUNvTEkDmMs

Blog Example - https://blog.bigbasket.com/2023/04/11/from-black-to-purple-rice-varieties-unleashed/

Which Features drive the best retention?

After discussing with many users and reading online reviews of bigbasket, the following features seem to drive the best retention amongst users:

- Order Again - For users who frequently buy certain items, it also shows the last time this order was purchased to keep the recency factor in place. This helps users in keeping a track of how long a certain item lasts and when they can expect to order again.

- Add items from previous order - This feature shows the most ordered with high recency products that the customer tends to buy. It also includes longer shelf life items where the probability of current inventory being low for that item is high, based on previous order data. It's easy to find and add and saves time instead of typing each product separately.

- Returns and Replacements (Customer Support) - In case of bad quality, missing or delayed deliveries, BB has a no questions asked policy. The customer support is very active, fast and gives immediate resolutions. They also ensure that the same item quality does not go down in the next order. Even if the product is bad and you refuse to receive it, within minutes the amount is credited back to you.

- Time-slot based delivery (BB SuperSaver) - This helps users to frequently come to the app, add items as they remember and when everything is added, at their convenience they can pick a slot to get all items delivered together. This is helpful for users who don't want urgent orders and also don't want to organize smaller orders more frequently.

- Management of online payment failures (BB SuperSaver) - In case of payment failures, order is never cancelled at BB SuperSaver. They place the order before payment is even processed and give user the option to pay anytime between order placement to delivery (online) or pay to the delivery partner (online or COD)

- Neu Coins - Customer receives these for all purchases (if they have opted for NeuPass, a free membership of Tata digital products) and can be used to pay in the next order instead of cash. Although the amount is small, if cart size is good enough, this negates the packaging and handling charges and overall additional charges becomes '0' for the order - for every order.

- Special labels (Organically Grown, BB Partnership with Indian Farmers, No Preservatives) - This helps the purchase decision for more conscious buyers. Interestingly there is no huge difference between price for these products vs normal ones and they are kept one below the other to ease the decision making process for the user. For ex. Hybrid tomatoes and Organic tomatoes would be one below the other in the category for easy decision.

- Last order date below the product - Every product that is ordered even once in the last 365 days, has a date associated with it which helps the customer in understanding how frequently this product is getting over and needs to be replenished. It also gives a sense of trust and personalization that you ordered the last time from BB, so let's buy this time also from BB.

- Event Or Time specific suggestions below the Basket Summary (Festivals, Back to School, Rainy season, etc.) - Scrolling Menu bar on the app landing along with categories called out at multiple points of interactions within the app help in adding items that are not regularly brought and can be missed. Like colours for Holi or Rakhis / Chocolates / Gifts for Raksha Bandhan

Churn and it's reasons

Definition of Churn:

Churned users are those that at one point did use the app in some frequency but now don't use it anymore. Considering user surveys, calls and the unique conditions in which their order frequency may have reduced, we would define a user as churned by adding a certain period of time to the time in which we can still call a user as a Casual user. In this case we would consider 60 days (Casual's Natural Frequency - 1 order in 30 days) as the time in which if no order is placed, we would call this user as as a Churned user. Between D30 to D60 this user remains an 'At Risk' user. As a Power users frequency reduces, it moves through the stages of being a Core, Casual, At Risk and eventually a Churned user if no order is placed even after 60 days.

Core Reasons:

A detailed survey by users gives the following insights into what they don't like about the app or what if happens repeatedly would force them to go for the alternatives or competitors:

Segmentation of Core Reasons:

Reason | Category | Insight |

Quality issues in the products - Expired, Damaged, Spoilt products | Voluntary | Competitor (Q Commerce or Physical stores) have better quality products |

Slow deliveries compared to other apps | Voluntary | Competitor Q Commerce apps deliver faster than BB Now |

Products I want are not available or sold by BigBasket | Involuntary | Competitor apps have more inventory and SKUs than BigBasket |

Products are more expensive than other apps or physical stores | Voluntary | Competitor apps or physical stores have certain products priced better than BigBasket |

I don't want to buy groceries online anymore and like the offline experience | Voluntary | Preference for touch and feel of the product to understand quality |

Less number of discount and offer options compared to other apps | Voluntary | Competitor apps have more discounts and offers |

Quality issues in the product packaging | Voluntary | Competitor apps have better packaging |

Shifted to a city or location where they are not present | Involuntary | BigBasket doesn't service in certain areas |

Difficult to use the app - lot of technical issues | Involuntary | The app crashes or certain pages don't work or open or PG doesn't open |

Products are usually missing from the full order or wrong products are sent | Voluntary | Verification with the order is not done when products are being packed |

Major illness or life event (Having a child, pregnancy, competitive exams, etc.) | Involuntary | Customer is not doing purchases by themselves |

Payment issues - Payment method not available | Involuntary | Customer only has one mode of payment option and that is not available or working at BigBasket |

High delivery charges | Voluntary | Competitors have lower delivery charges compared to BigBasket |

Negative Actions:

- Abandoned Basket - In case the user is unable to make the payment OR finds total value to be very high for the same products bought from competitor apps OR finds no discounts or offers when moving for payments OR does not find convenient slot for delivery / fast delivery option, they may end up moving to the competitors. If basket abandonment is frequent, it shows that they are buying the same products with competitors.

- Low NPS / CSAT score - A low score for this indicates that the customer is facing multiple issues in ordering from the app or with the delivered products. Consistent low scores will move that as well as potential users to competitors.

- Uninstalled App - Once the app is uninstalled, the probability of coming back and installing the app is very thin and most likely we have completely lost the user to a competitor.

- Bad reviews for products delivered on social media platforms - This creates 2 problems - moves this customer to alternative or competitor platforms while also discouraging more users to buy with BigBasket for the first time.

- Reduction in frequency of using the app - If a user is not performing as per their natural frequency, there is a high probability that the rest of the orders are being placed on another app and BigBasket is slowing becoming a secondary app for this user.

- Drastic increase in support tickets raised - More support tickets raised means more issues that the customer is facing in the app. Even if resolution is provided for these tickets, if the user has to consistently ask for same problems to be solved by a support agent, they would switch to a competitor app.

- Not adding money to Wallet - This is for users who frequently added to wallet and made purchases using the wallet. If the user is not adding money to wallet, chances are that they are planning to reduce the frequency of purchase from BigBasket or likely not willing to buy from BB unless necessary.

- Dropping from payment page / Cancelling payment - Dropping at this stage means that the customer is not satisfied with the payment options that BB has to offer and have decided to buy these products from elsewhere. If this happens repeatedly, they will involuntarily move to another platform.

- Stop receiving notifications about promotions from all platforms - If the user is not interested in the offers or communications sent by BigBasket that means they are not interested in availing them either.

Resurrection Campaigns

The Resurrection campaigns focus on users who are at risk of churning or have already churned due to Voluntary reasons. The pitch is framed in a fashion similar to how BB communicates on these channels right now. (References given in the 'Channels that drive the best retention' section.

Campaign # | Campaign 1 | Campaign 2 | Campaign 3 |

Segmentation of User Type | Users who have given bad ratings for late delivery, recency is 3 weeks | Users who abandon basket frequently, last order was a month back | Users who have repeatedly raised customer support tickets owing to products missing, quality issues or incorrect product sent, have seen a reduction in frequency of orders and last order 2 weeks ago |

Pain point | Slow deliveries | Products are expensive compared to competitors | Products are usually missing from the full order or wrong products are sent |

Goal of the campaign | Increase their orders with BB Now with better ratings | Increase their basket to order placement rate, in-turn increasing their frequencing of ordering | Encourage them to buy again and eventually increase the frequency of orders |

Offer | Delivery Guarantee or get Cashback offer - If order is not delivered within the time mentioned while placing the order, the delivery charges are refunded and additional INR 100 cashback is credited to Wallet. (Applicable for 4 orders a month) | Win 2-5% cashback, using a scratch card, on every order placed. No upper limits. | 10% discount on your next order |

Pitch / Content | WhatsApp: 😵💫 Late deliveries your biggest concern? Don't worry, we got you covered! 😇

👩🍳👨🍳 Let's get cooking! | Push Notification: Promised cashback on every order, buy now 🛒 👉 40000+ products to choose from 👉 2 to 5% cashback on every order* 👉 Random free deliveries CTA: Add to Cart Now >> | WhatsApp: 🆓 10% Flat Discount 🆓 Gajal, Enjoy 10% discount on your next order, a limited period offer. - Instant discount on cart value (Up to INR 200) - 40000 products to choose from - Book your delivery slot and chill while we send your order

🔥 Save more with BigBasket |

Frequency | Twice in 15 days | Twice after abandoning basket | Once every 3 weeks |

Timing | Alternating between morning and evening | Within 24 hours of abandoning the basket After 7 days of abandoning the basket | Late evening (6 to 8pm) |

Channel | Push Notification, WhatsApp | Push Notification, Email | WhatsApp, Email |

Success metrics | - CTR - Increase in number of orders | - CTR - Conversion rate | - CTR - Conversion rate |

Why did I choose this campaign for this user? | A user who is experiencing issues with slow or late deliveries needs some incentive to consider buying again specially on the delivery side. Compensating them with cashback on slow deliveries can bring back trust and would also help BB understand how many such users and how many such late deliveries currently exist in the system | A user who is abandoning the basket is likely buying those products from elsewhere. Encouraging them to buy with BigBasket and complete the order of items in the basket can be done using cashbacks. | These are disgruntled users facing some issue with the product or delivery instead of the proces. These users when given a flat fixed discount without any sugar coating or masking or additional step required to avail the discount can encourage them to try buying from BB again. |

Campaign # | Campaign 4 | Campaign 5 |

Segmentation of User Type | Users who have a gradually reducing order frequency over time, mostly moved to a competitor, recency is one month | Users who have completely churned out, not used the app in over 2 months and need to be resurrected |

Pain point | Less offers and discounts compared to other apps | Products are expensive compared to competitors |

Goal of the campaign | Increase interaction on the app and increase number of orders | Re-engage these users with BigBasket |

Offer | No delivery charge for your next 5 orders and a free goodie product every alternate order | Place orders of above INR 600 to count it as a streak and get a cashback of incremental value (+2% with every order) i.e. without streak break the cashback % becomes better. Order 1 - 5% Order 2 - 7% If the streak is broken, it again starts with 5%. Counter restarts at the end of 30 days. |

Pitch / Content | WhatsApp: 🚚 No Delivery Charges 📦 Gajal, Enjoy free delivery on your next 5 orders AND there's more - No delivery charge for 5 orders - Free goodie product to try out, sent on every alternate order - BB Now has 7000+ products in the categories you love to buy from Buy Now: <Link> 🏃♀️Order now to avail the offer, limited time offer 🏃 | Push Notification: Gajal! Start your BB Streak and get more 🤑 👉 5% cashback on your next order, increasing by 2% every order* 👉 More than 7000 products to choose from 👉 Free goodies on chosen orders CTA: Check BB Streak >> |

Frequency | Twice a month, 15 days gap between each channel | Once every 2 weeks |

Timing | Early evenings (4 to 6pm) | 30 mins before their usual order timings |

Channel | Email, WhatsApp | WhatsApp, Push notification |

Success metrics | - CTR - Conversion rate - Increase in # of orders placed | - CTR - Increase in # of orders - Increase in basket size / number of products added |

Why did I choose this campaign for this user? | These are price sensitive users, specially ordering smaller SKUs and facing heavy delivery charges. Given a breather from the delivery charges, their tendency to make purchases may increase. | These are price sensitive users who have already found alterante ways of getting their products. Showing them a way of getting cashback on every order, % increasing with every order can help in re-engaging them with the platform. |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.